The New Deduction for Pass-Through Businesses

New year, new firm, new blog! Big changes in 2018, not just for myself, but for the area of law I practice in – the very exciting area of Tax Law. Don’t fall asleep just yet! I promise you will find this blog entertaining and informative (ok – probably just informative). January’s post is dedicated to the 20% deduction available to most of us small pass-through entity business owners, under the new Tax Cuts and Jobs Act.

The 20% Reduction of Taxable Business Income for Pass-Through Entities

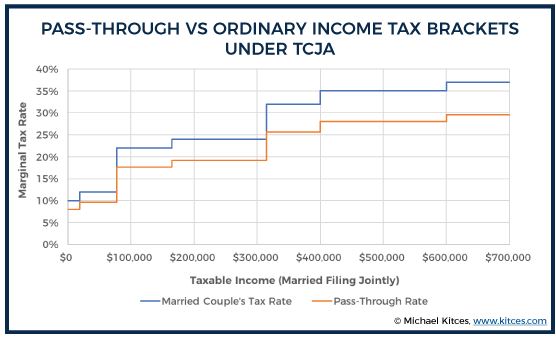

First, you need to know what a pass-through entity is. A pass-through entity can be a partnership, S corporation, limited liability company or partnership, or sole proprietorship — basically, most of the country’s small businesses (hovering around 95% of US businesses). Owners and shareholders of these entities are taxed on earnings based on individual, not corporate, tax rates. Effectively, company earnings, losses and deductions pass through to the individual’s personal tax rates.

This deduction is limited in both time and amount of qualified business income (QBI). Unless Congress extends the time, the available pass-through 20% reduction is set to expire in 2025. And, to take advantage of the 20% reduction you must report a business profit. So, what is QBI?

QBI includes: Rental income from a rental business; Income from publicly traded partnerships; Real estate investments trusts; and Qualified cooperatives. QBI does NOT include: Dividend income; Interest income; S corporation shareholder wages; Business income earned outside the United States; Guaranteed payments to LLC members or partnership partners; and Capital gain or loss.

If you want to know how your small business can take advantage of this 20% reduction, what the income limitations are, or when it is proper to be classified as a pass-through entity to take advantage of the new 20% reduction verses a corporation that is now taxed at a flat 21% tax rate – call AnnaMarie L. Mitchell, P.A. at 727-230-0333!

Leave a Comment

(0 Comments)